Arizona Construction Job Activity for Q1 2024

![]()

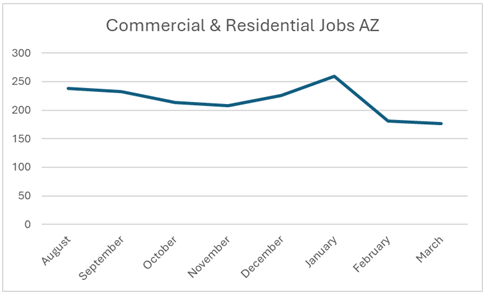

The past eight months have been tumultuous for Arizona's construction market. An unexplained surge in December saw 37% of our annual revenue generated in that month alone, likely fueled by optimism surrounding the decreasing inflation rates during that period. However, the unexpected rise in inflation figures for February and March reversed this momentum, leading to a noticeable downturn.

Throughout 2023, several sectors kept the market active, particularly industrial projects. Multifamily developments were one of those sectors and demand remained strong, primarily due to projects that were already scheduled. Early in the year, luxury developers halted hiring, but developers focused on affordable housing faced overwhelming demand. As interest rates continued to climb throughout the year, however, these developers began to scale back their projects. With their target market being the lower and middle-income brackets, raising prices to offset rising debt costs was not feasible.

So far, 2024 has seen little in the way of new multifamily developments, with companies focusing on staffing for existing projects. Without new multifamily developments entering the market, 2024 is shaping up to be a slow year.

Despite these challenges, we believe the long-term demand for construction in Arizona remains robust. The state's population is growing, and investment levels are at record highs. However, the ongoing battle between short-term high interest rates and long-term construction demand is currently favoring the former.