Emerging Trends: Job Market Overview for Q1 2024

Emerging Trends: Job Market Overview for Q1 2024

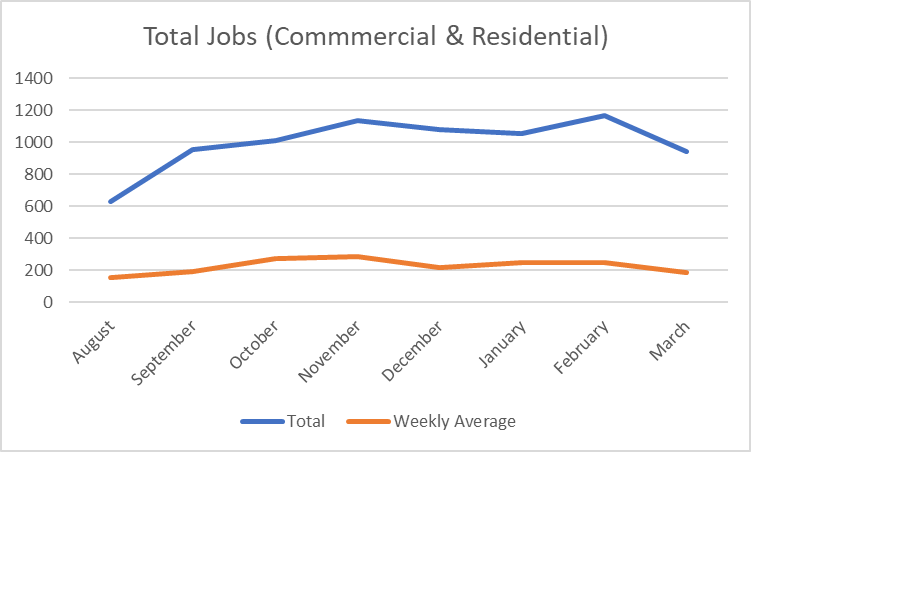

The first quarter of 2024 began with a surge in market confidence, leading to an increase in job creation. This rise was largely attributed to the anticipation of multiple interest rate cuts within the year, with the first expected in the summer. However, a series of strong economic indicators from the U.S. economy, alongside an unforeseen rise in inflation, quickly dampened the possibility of an early rate cut. Consequently, March experienced a significant decline in job postings.

To offer a clearer view, the average number of job postings in the last six weeks stood at 199, compared to 274 during the year's first six weeks.

While interest rates do not fully encompass the nuances of the construction market, they have become a dominant factor influencing its direction. Multifamily construction, generally considered more resilient due to substantial population growth in many of the markets it serves, has now seen a slowdown in new projects due to the restrictive interest rates. The luxury multifamily segment began to decelerate at the start of 2023, and the affordable housing sector, despite high demand for its products, has been unable to offset the higher rates to its customers, leading to a standstill in affordable developments.

In summary, the initial optimism in the job market at the start of 2024, fuelled by expectations of interest rate cuts, was short-lived due to stronger than anticipated economic performance and rising inflation in the U.S. This shift in economic conditions directly impacted the construction sector, particularly in the multifamily segment, leading to a notable slowdown in new projects and job creation as the year progressed.